One of the first things new employees often get taught when they join a professional services company is how to create their timesheet. This is usually not a simple “I worked 8 hours on Monday.” Instead, it’s a detailed accounting of how much time was spent on each task of each project. In many firms, this also includes internal work, such as training and business development. For businesses in the professional services sector, customers are often billed based on these timesheets. This data is also used to track one of the Key Performance Indicators (KPIs) used by many of these businesses: the billability rate.

Overview of Billability Rate

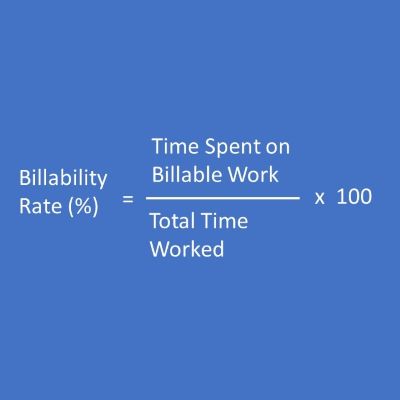

The calculation for the billability rate, often referred to as utilization rate (we’ll discuss potential differences later), is quite simple: billable time divided by total time, all multiplied by 100. Billable time is defined as time spent on projects that a client is paying for. Total time includes all time worked, whether it’s project work, hiring, or internal R&D. In many companies, total time includes all time employees are paid for, such as paid time off. Like all good metrics, billability should be measured with some timeframe in mind, such as monthly or quarterly. Measuring at the daily or weekly level can be easily skewed, particularly if employees are at a conference or on vacation. Billability can be measured at the company level, department level, employee level, or any other grouping a business uses.

Why do consulting businesses care about billability so much?

It’s easy to see why professional services businesses like the billability metric since it’s correlated with revenue. More hours billed means more money flowing in. It’s also an actionable metric. For example, if billability consistently falls below targets, steps might need to be taken to increase the pipeline of new business or slow the hiring of new staff. If billability is above target levels, that’s an indicator that more staff may be necessary. Finally, billability is an easy-to-understand metric. While there is some nuance, such as which hours get included in the “total hours” part of the calculation, the formula is straightforward. Billability is also a great metric to visualize on custom dashboards for business leaders.

What are the downsides to measuring billability?

Billability is a good measure of how employees are positioned towards helping a company achieve revenue goals. However, this metric is often used to measure individual employee performance. There are several issues that this leads to. In many cases, employees aren’t directly responsible for their individual workload. In such cases, judging an employee on their billability rate is like judging the server at a restaurant on the taste of food. Billability also doesn’t typically account for other activities that an employee is working on that may contribute value to a company. This may include sales or new service development.

Finally, if employees are held to strict billability targets, this may lead to them slowing their progress on billable tasks, which can impact project budgets and schedules. This doesn’t mean that I recommend against measuring the billability of employees, only that it should be interpreted through the lens of ensuring efficient staff allocation.

It’s also important to keep in mind that while revenue and billability rates are correlated, this metric does not account for the actual dollar rates employees are billed at. More senior employees are almost universally billed at a higher rate. An employee that gets billed at $50/hour will bring in the same revenue in 4 hours that an employee billed at $100/hour will generate in 2 hours. Therefore, it’s important to think of billability rates as a measure of how well employees have been set up to bring in revenue, not their direct contribution.

Billability Rate vs Utilization Rate

The terms billability rate and utilization rate are often used interchangeably, because to many businesses, they genuinely mean the same thing. This makes sense, because billable work correlates with revenue, and that is often the top priority. In the last section, I mentioned how there are other forms of work an employee may be working on that provide value. This work may lead to future revenue. Therefore, it might make sense to think of the utilization rate as a measure of what percentage of staff time is spent on activities that provide value or positive impact to a business. Time spent on proposals, training, R&D, and hiring might all count. This could be a good measurement of employee productivity, even when they don’t have billable work to do.

Planned vs Actual Billability

We often talk about the billability rate as a lagging metric since we measure it after hours have been worked. We should think of this as the actual billability rate. Businesses that have processes in place to allocate staff for upcoming project work can also measure a planned billability rate over the upcoming weeks, months, or quarters. This has the benefit of providing insight into the future and can ensure more efficient staff allocation. It might make sense to not just look at future billable work in such measurements, but all allocated time, to account for conferences or vacations that make an employee unavailable for other work. This is something that works well visualized on a dashboard that facilitates decision making.

Billability Targets

It’s important to set realistic targets when using billability rates to judge success. In my experience working in consulting firms, there is no magic value to use. This might be based on expected contribution to revenue or historical patterns within a firm. Target billability rates may even differ within a single firm. Senior staff often have lower targets than junior staff. This is because senior staff are expected to be more actively involved in non-revenue generating activities such as business development and hiring. Since paid time off can count towards total time worked, it’s often necessary to account for this in setting a target. When measuring billability for a group of employees with different targets, it may be useful to measure the percentage of employees meeting individual billability targets.

The Final Word on Billability

The billability rate is a mainstay metric of professional services businesses because it measures how well staff have spent their time generating revenue. It’s also an actionable metric that meets the criteria of being a good KPI. This means that it’s Specific (clear formula), Measurable (from timesheets), Achievable (if realistic targets are set), Relevant (correlates to revenue), and Time-Bound (when measured over a clear timeframe). AKA it’s a SMART metric, which I’ll talk about another time. It works as a good measure of resource allocation and revenue generation, but it doesn’t always work for measuring employee performance.

This is of course only one metric that professional services businesses should be using. If you want to identify metrics for your organizations and be able to view them on an accessible dashboard that helps you make decisions, let’s talk more!